Reporting Solution for Netherlands Account Reporting

FATCA, CRS and domestic ‘renseignering’

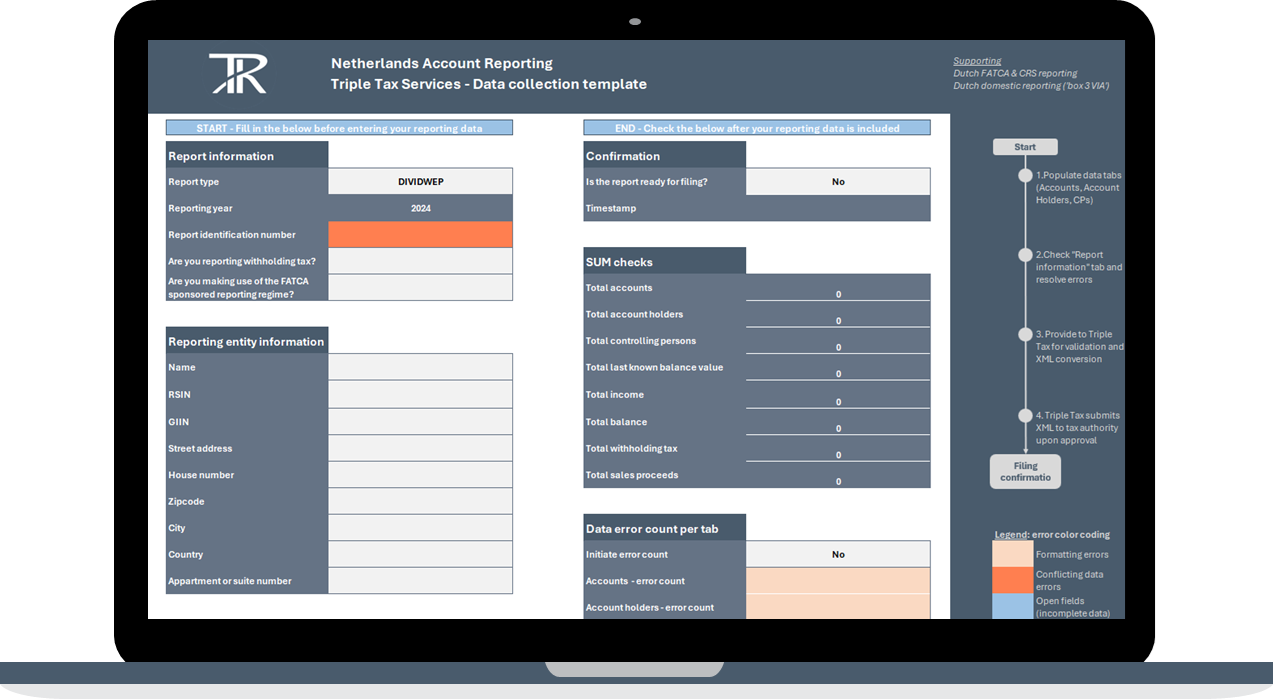

It’s as easy as filling-out an advanced excel sheet, and we take care of the rest.

Discover how the reporting solution works

Four steps to execute reporting:

-

Use usual excel functions and built-in guidance, or let us handle the data input for you.

Use built-in visual feedback on open fields, errors, and conflicts to quickly identify and resolve issues.

Use the dashboard for a comprehensive view of your data's quality and readiness.

In the self-service model a demo and first time assistance with populating the excel is included.

-

Upload the template to the Triple Tax client SharePoint; or

Choose any other method that works best for you.

-

Executed entirely in the Triple Tax Microsoft Cloud, we validate your data and convert it to the Dutch XML schema.

The XML Report Generator reads the data collection template and generates the XML report directly in SharePoint. It can also connect to other data sources, such as your own SharePoint or Dataverse.

-

We can submit the XML report on your behalf and share the tax authority return message; or

Provide you with the XML report to enable you to submit on your own - or your client’s - behalf. In this model we act as your software provider.

Design principles and features

Our solution is entirely developed and maintained in-house, reflecting over a decade of expertise in FATCA, CRS, and Dutch domestic account reporting. From the first FATCA reports on 2014 to account reporting today, our solution combines tax expertise and data handling, while prioritizing security and user experience.

| User-friendly | Security by design | Built for performance |

|---|---|---|

| ✓ Intuitive data collection | ✓ Secure data sharing | ✓ Scalable design |

| ✓ Dashboard function | ✓ Data is solely processed in Triple Tax Microsoft environment | ✓ Optimized workflow |

| ✓ Data validation and visual feedback | ✓ Data is solely accessible to Triple Tax staff | ✓ Smooth functionality and easy data entry |

Reporting types and deadlines

The reporting solution covers the following reporting types and deadlines.

| Your Products | Reporting types | Reporting deadlines |

|---|---|---|

| Investment funds and investment products | DIVIDWEP, incl. FATCA/CRS | Ultimately 1 February of subsequent year |

| Loan products held by individuals | LENSAGEG | Ultimately 1 February of subsequent year |

| Payments and savings products | RENSAGEG, incl. FATCA/CRS | Ultimately 1 May of subsequent year |

| Products held by U.S. and CRS reportable persons | FATCA/CRS only | Ultimately 1 August of subsequent year |

Multiple offering models to align with your goals

-

The ideal self-help solution: simply populate the data collection template, and Triple Tax will take care of the rest.

In this model, Triple Tax will:

Provide the data collection template for self-population. In this model a demo and first time assistance with populating the excel is included.

Perform a consistency check on the completed template.

Generate the XML report.

Submit the report to the Dutch tax authority upon your approval and forward the return messages.

Alternatively, we can provide the XML report for self-submission. In this scenario you should self-register in the Dutch Tax Authority reporting portal.

* If desired, we provide on-site data mapping and validation support.

-

A comprehensive, hands-on solution where Triple Tax annually collects and works with the source information that you have available - to limit your workload.

In this model, Triple Tax will:

Collect your available information and prepare a reusable working paper containing all relevant information for the reporting year.

Integrate the working paper with the data collection template for one-on-one population of reportable data.

Generate the XML report(s).

Submit the report(s) to the Dutch tax authority upon your approval and capture the return messages.

Maintain a clear audit trail designed for efficient recurring reporting.

* If desired, we can assist with preparing the CRS notifications for reportable account holders in a standardized manner.

-

The most comprehensive solution for organizations aiming to minimize their operational burden. Triple Tax provides ongoing support for all FATCA and CRS process components.

In this model, Triple Tax will – in addition to the Extended Reporting Service:

Support all FATCA and CRS processes, including legal entity classifications and account holder or investor due diligence.

Quarterly check-in to assist with and process factual changes and – when applicable inform you on relevant legislative updates.

Maintain a process and database in which factual updates throughout the year are captured.

The process and database are designed to ensure efficiency and consistency across reporting years. By capturing data throughout the year, we enable continuous compliance and simplify year-end reporting, making it nearly a ‘push-on-a-button’ process.

* All models can be tailored. For this reporting service Triple Tax Services B.V. is registered with the Dutch Tax Authority as a software provider.