This page was last updated in April 2025.

Library | DAC7 explainers and references

Welcome to our DAC7 library. Scroll down for our explainers on:

What is DAC7 about?

Activities in scope of DAC7, including examples.

What does DAC7 require from Digital Platforms Operators?

Three key challenges for Digital Platform Operators.

Market perception of DAC7.

Click here for information on:

What is DAC7 about?

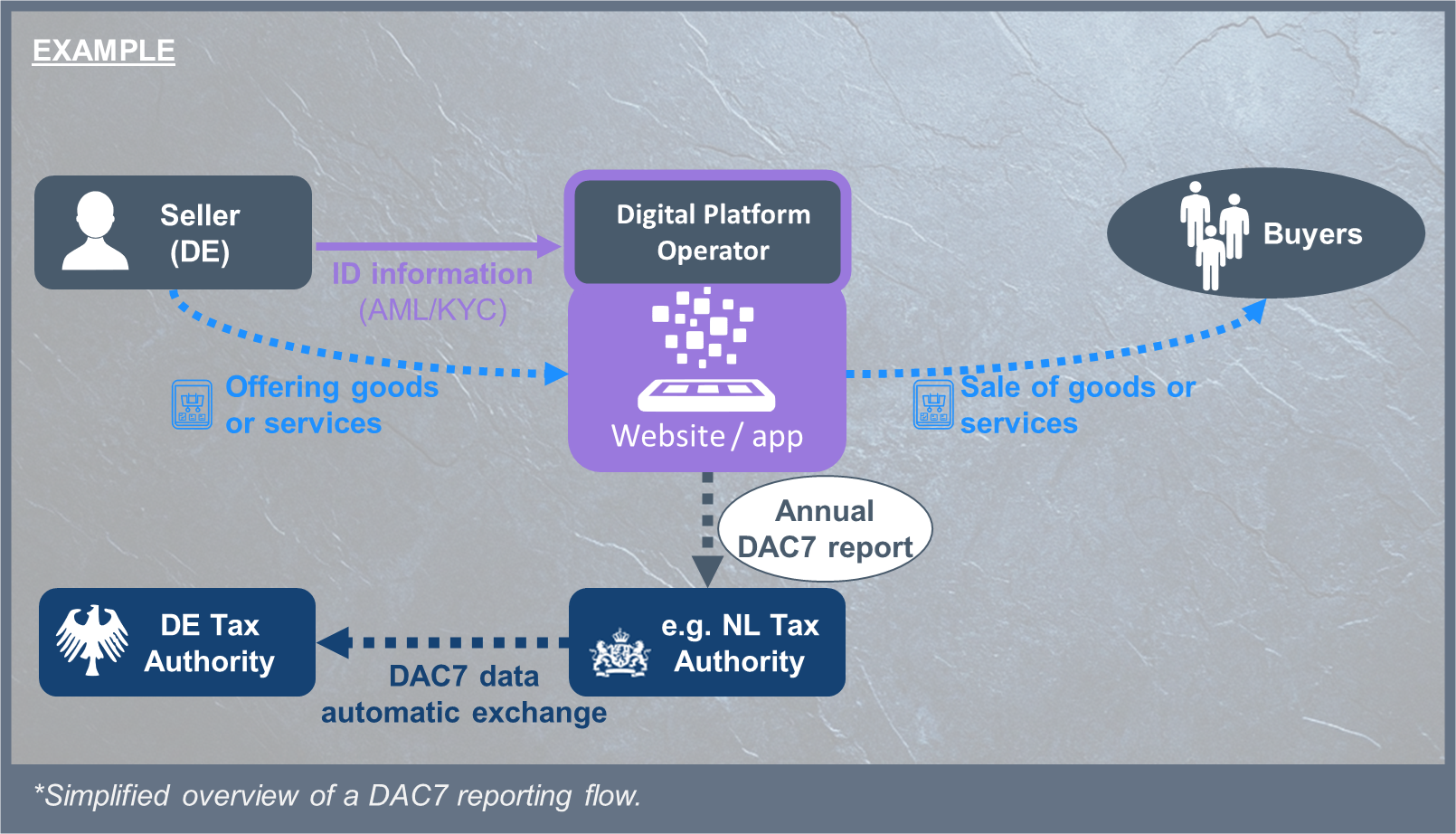

DAC7 extends the EU's transparency efforts to both large and small digital platforms that facilitate sales or services between third-party sellers and buyers via a website or an app. DAC7 applies to Digital Platform Operators located in and outside the EU, to the extent they are active in the EU.

Digital Platform Operators are to report income earned by sellers on their platforms. Tax authorities throughout the EU will use this information to verify the completeness and accuracy of sellers’ personal and business tax returns (incl. VAT returns). While DAC7 does not create any new taxable events, it serves as a tool for tax authorities to verify taxpayers' compliance with existing tax obligations.

DAC7 is an amendment to the EU Directive on administrative cooperation in the field of taxation. DAC7 is introduced via EU Directive 2021/514. DAC7 is implemented across EU member states.

The first DAC7 reporting occurred in 2024 on reporting year 2023. First full reporting occurs in 2025 on reporting year 2024.

Requirements for digital platforms

A legal assessment is recommended to determine if the platform activities fall within the scope of DAC7, and to identify which sellers and transactions are affected. When in scope of DAC7, the Digital Platform Operator must register in a single EU member state, regardless of whether the Digital Platform is located within the EU, or in multiple EU jurisdictions.

the following key operational processes apply:

-

Continuously identify and document the pre-scribed identification details of their sellers and monitor for changes in sellers’ details, such as the country where they are residing.

-

Continuously collect and maintain transaction data that may have to be reported.

-

Annually report seller and transaction data to the tax authorities. Reporting is be done following the close of the reporting year via the channel that the local tax authority prescribes. Digital Platform Operators that are located outside the EU can decide in which EU jurisdiction they report.

Activities in scope of DAC7 reporting

Many types of sales or services via websites or apps are in scope of DAC7.

Examples:

Rental of immovable property, for example renting out your home via a website or app.

Personal services, for example offering online training and coaching sessions via a website or app.

Sale of goods, for example the sale of second hand goods via a website or app.

Rental of any mode of transport, for example renting out a car or bike via a website or app.

DAC7 also applies to companies which - on the side - facilitate a sale or service on their website between a seller and a buyer, and that are reasonably aware of the consideration paid for the sale or service.

Examples:

A local sports club or restaurant which facilitates the sale of art from a local painter via its website.

A financial institution which facilitates the sale of home appliances to its customers via its website.

A learning institute which also allows freelance trainers to offer their services via their website.

A reporting threshold applies for the sale of goods. A digital platform is only required to report on a seller if it in a year (i) sold goods for more than EUR 2000,- or (ii) made at least 30 sales. For the other activities no thresholds apply, unless a rare seller related exemption applies. Platforms outside the EU may benefit from certain ‘switch-off’ clauses.

High data quality and compliance standards

As usual with tax information reporting obligations, Digital Platform Operators are to implement and maintain an adequate compliance program to ensure high data quality standards. Digital Platform Operators must also take measures to protect sensitive seller (or customer) information such as personal tax identification numbers.

Digital Platform Operators may be subjected to inquiry by local tax authorities on the adequacy and maturity of their measures, or ‘compliance framework’. Adequacy usually depends on the size and business characteristics of the digital platform, and the speed and diligence of the follow-up to errors and omissions found in the execution of DAC7 obligations.

Compliance frameworks typically cover:

-

Including adequate control measures to mitigate applicable risks, ensuring consistent execution of operational processes, prevent fraud and minimize human error.

-

Digital platforms may be expected to execute DAC7 in a highly digitalized manner, leveraging logic implemented in self-built software or third-party applications. To recognize errors and omissions, a combination of data driven controls and statistical testing may be desired depending on the business characteristics.

-

Staff working on DAC7 obligations should be trained to understand the tax obligations that apply and how to meet these obligations day-to-day.

Market perception

While the EU's harmonized efforts to combat tax evasion represent a step forward, the measures introduced under DAC7 have faced market criticism. Critics question whether the reporting obligations unduly burden digital platforms relative to the value of the information collected. For instance, there is concern that DAC7 may cover too many digital platforms operating in industries less prone to tax evasion, such as second-hand goods sales, as well as doubts about whether tax authorities are equipped to effectively utilize the data they receive.

Three key challenges for Digital Platforms

DAC7 subjects to digital platforms to similar tax information reporting requirements and standards as apply to the financial sector. In effect DAC7 allocates a financial gatekeeper role to digital platforms. This is not a role that many digital platforms set out to fulfil at their inception.

1. Communication with sellers

Digital platforms often act in competitive industries. The seller may consider changing to another platform if: the digital platform’s request for personal identification information is perceived as burdensome, badly communicated or the digital platform is not able to address concerns that the seller raises about how his information will be used.

2. Software limitations

Both self-developed as well as third party software usually does not provide a full response to DAC7 requirements. Some written processes and sufficiently trained staff will be required. The systems logic and process will have to be kept up-to-date and staff must be able to manually handle exception cases.

3. Limited availability of expertise

In-house tax and legal staff are usually not trained on DAC7 type of legislation, while seller onboarding, changes in circumstance monitoring, data preparation and annual reporting process steps have to be implemented in within an organization that is initially not setup to handle such requirements.